False Promises: Going Passive is Not Momentum Investing

There is some popular marketing spin going around that indexing—constructing portfolios based on market-cap weights—is effective because it allows an investor to own more of companies that have been successful and appreciated, while moving away from losers that have been unsuccessful and declined.

This sounds logical, but it is empirically wrong.

The strategy suggested above is tantamount to a diluted form of momentum investing, which seeks stocks that have appreciated recently and avoid those that have fallen in price.

But the devil is in the details. The above is false because it doesn’t take into account the investment horizon over which indexes hold positions and the momentum factor delivers return.

Let’s look at the data.

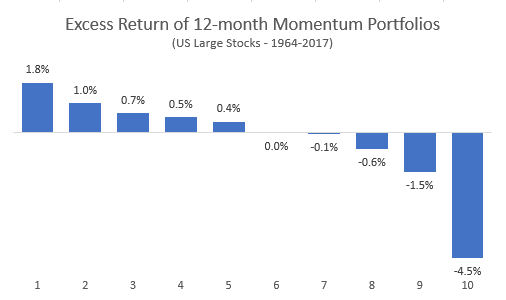

Momentum investing does work over time. The below creates a series of momentum portfolios—strong momentum on the left, poor momentum on the right. Strong momentum stocks do, in fact, outperform while weak momentum stocks underperform.

But, lets take a deeper dive. If you invest in a strong momentum name (decile 1 above), how does the outperformance come? Does it all come in the next month, 6-months, 12-months, 2 years? How long does the signal remain effective before you need to move out of that momentum name and into another strong momentum name?

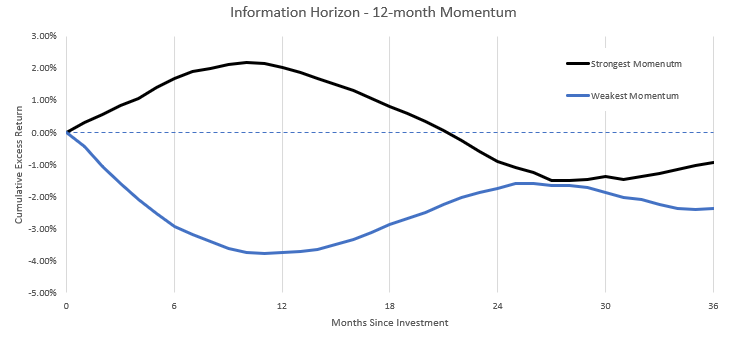

The chart below answers the question. It is the information horizon for momentum investing using 12-month momentum. The logic would go as follows. If someone finds a strong momentum stock and makes an investment, on average, how will they get rewarded, relative to the market.

If you made an investment in one of the top 3 momentum portfolios at time 0 and held it for 36 months, this would be your average cumulative return relative to the market at each holding period-- 6, 12, 18, 24, 30, and 36 months.

As you can see, excess return (return better than the market) peaks at about 10 months. Then you see a decline in the strongest momentum decile. This is reversion to mean in action. Whatever the behavioral phenomenon—I would say it’s initial excessive optimism— that originally drove the misprising has worked itself out and performance has reverted. If the investor holds the strong momentum stock too long, that outperformance erodes and even turns negative.

In other words, if you don't move out of momentum names, you will end up underperforming.

For simplicity’s sake, let’s say the optimal holding period, selling at the peak, is 12 months. This suggests that the entire "strongest momentum" portfolio must turn over every 12 months--100% turnover to realize the benefits of momentum. For the middling momentum deciles, it needs to turnover even faster.

Last I checked, no passive cap-weighted indexes have anything near 100% turnover. If they did, it would be completely antithetical to their objective, low cost exposure to the market. It is empirically impossible for low turnover cap-weighted indexes to provide value-add momentum exposure over a market cycle.

In fact, over longer periods, they actually provide the opposite! Why? Because the turnover for passive funds is 3%, not 100%! (Turnover of SPY per Morningstar). A 3% turnover implies a holding period of 33 years. I wonder what the momentum horizon looks like over 33 years?

Because the holding period is so long, cap-weighted strategies can actually have negative contribution from momentum over long periods. Here’s why... compounding. The excess return (outperformance) for an investor in the strongest momentum decile peaks at 2.17% in month 10, but then goes on to lose all the gains by month 21 and then produce underperformance for a cumulative return of -1.49% in month 27.

A more nuanced implication of the Investment Horizon chart is that more of your capital is “at risk” at the peak of this curve than at the bottom. If you have more money at risk before a downturn in performance, it stands to reason that all of those gains erode and you eventually end up in a worse position than when you started.

This phenomenon is why investors would actually be much better off in an annually rebalanced equal-weighted portfolio. A portfolio that set each position at the same weight for one year (approximately the optimal momentum holding period) implicitly buys into beaten down names ("Weakest Momentum" in the chart below) that could be about to revert in the information horizon and sells ones that have appreciated to the peak of the horizon ("Strongest Momentum" in chart below).

Don’t believe the spin, passive cap-weighted products are market exposure, not momentum investing.